If you’re looking to build a startup with the goal of eventually selling it, this guide has the information you need to know on the topic of startup acquisition.

A startup exit event occurs when the founders and investors in a company liquidate some or all of their shares in the venture. The most common exit event is when the business is sold to a bigger business, which is usually called an acquisition.

1. For What Kind of Startups Are Exits a Good Idea?

For most growth-oriented startups, exit events are pretty much mandatory. These businesses typically operate at a loss for years in order to maximize growth (while surviving on venture capital money), which means that they are unable to pay dividends to their shareholders. Because of this, the exit is in fact the only event at which the startup investors and founders have an opportunity to realize a return on their investment.

That said, this is not the case for every type of business out there. Because of this, we’ll start this guide by discussing liquidity events for different types of businesses.

1.1 Small Lifestyle Businesses

A startup exit is not the default end of the entrepreneurial journey for most small-business owners. Small lifestyle businesses like restaurants, barbershops, all kinds of consultancies, etc., usually operate for years and the people who start the business are often the people who close it down if it becomes unprofitable.

Such businesses are sold, but this usually happens when personal circumstances pressure the founders into liquidating their assets (e.g. moving, getting ill, retiring, etc.). In general, out of all types of businesses, lifestyle businesses are the hardest to liquidate at a good price.

The reason for this is that most of the value of those businesses is locked into the founders themselves. If the founders are selling a service, most clients are buying their expertise and labor, and because of this, the founder’s reputation is much more valuable than the business brand. If the founders leave the business, the leftover assets are usually of little value.

Consequently, selling your mom and pop’s restaurant can be challenging and you usually wouldn’t open such a restaurant with the plan to sell it in a few years.

Before you are able to sell it, you’ll usually have to grow it into a brand so that the value shifts from the founders to the brand and all other business assets.

Since most high-risk equity investors aren’t interested in lifestyle businesses, you’ll have to grow your small business your way – through loans, savings and by reinvesting the profits into growth while retaining enough to pay yourself. The lifestyle businesses which are able to exit at a good valuation are usually family businesses that have successfully grown organically over the years with good products and services.

1.2 Small Liquid & Scalable Businesses

That said, not all small businesses are hard to exit. A whole ecosystem of highly-liquid online businesses like e-commerce stores, affiliate blogs, software as a service provider, etc. exists on online platforms like Empire Flippers, MicroAcquire and Flippa. On these marketplaces, many entrepreneurs buy such businesses intending to grow them and re-sell them later (i.e. to flip them).

There are a few key differences that make such businesses more liquid than the traditional lifestyle businesses we talked about above:

- First, the product or service offered is usually commoditized. The owner of the store does not usually represent the brand of the business.

- Second, location doesn’t matter as much. A founder running a dropshipping store from San Francisco can sell it to anybody in the word, while a physical store in San Francisco is limited only to buyers living in the same area.

- Third, operating online means that while there is a lot of competition, the growth ceiling is high and the rate of growth (of successful companies) is usually rapid.

1.3 Scalable & Disruptive Startups

While the abovementioned online businesses are liquid and founders usually start them with the intention to sell them in a few years, they are not what most people call real startups because they are usually not innovative and as a result – not that risky and with a lower growth ceiling.

True startups are typically disruptive with innovative solutions that aim to be the best in their market with the eventual goal to become a monopolist in their segment.

“Competition is for losers.” – Peter Thiel

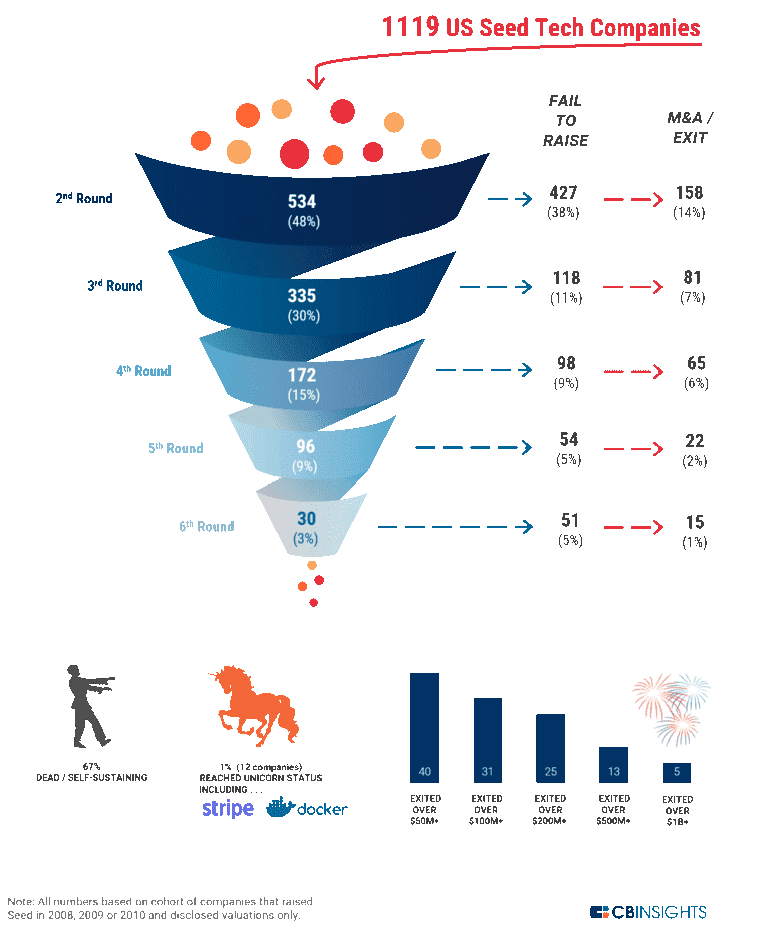

This means that successful tech startups have a chance to become billion-dollar businesses (unicorns), and of course, at the same time their chances of realizing that vision are extremely small (more than 90% of all startups fail). Being truly innovative increases the chances that you are offering something that the market isn’t prepared for, or that your offering is economically unsustainable.

Because of the nature of such businesses, rapid growth is critical for them. When product-market-fit is reached, the first business to take over the market will likely reap most of the benefits, so slow organic growth is usually out of the question for innovative startups.

Venture capitals are comfortable with tech startups operating at a loss for years in order to grow as fast as possible. Once an exit event is reached, investors are able to get a return on their investment. When successful, the extremely high returns of the most successful companies make up for the losses of all the unsuccessful startup investments.

In fact, the average successful venture-backed startup raises $41M and exits for $242.9M in 7 to 8 years.

This means that when you are starting an innovative startup, even if your goal is to work on it for life without exiting, the necessity for investors will push you towards exit events nonetheless. This, of course, doesn’t necessarily mean that the founder has to exit. However, it means that the equity stake of the founder(s) will be diluted (i.e. after consecutive equity funding rounds the founders own a smaller share in the company).

2. Different Types of Startup Exits

2.1 Startup Acquisition

One business buying another is by far the most common startup exit. It’s the standard exit not only for startups but for all the different kinds of businesses we mentioned above.

The exact reasons for each acquisition are case-specific, but there are common ones:

- Defensive acquisitions: As mentioned, most tech startups aim to be a monopolist in their own market. This means that buying-out fast-growing startups in your niche is a good way to control them before they become a real threat. For public companies, stock market liquidity puts tech giants in a great position for multi-billion dollar acquisitions. Good examples are Facebook’s acquisition of Instagram and WhatsApp.

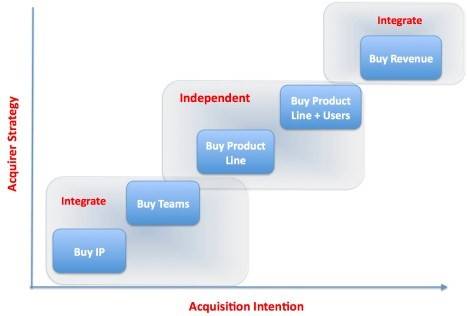

- IP acquisitions: A business might want to hold the intellectual property rights of a newly developed technology or brand. Acquiring tech startups instead of investing in R&D is like the acquiring company outsourced the early-stage risk to the entrepreneurs and startup investors. Although buyers usually pay a premium for the acquisition, it is often worth the time it would have taken them to develop similar solutions assuming those innovations are not legally protected.

- Acquihires: Sometimes the most valuable asset of a business isn’t the brand or technology, but the team building it. Tech giants often buy-out innovative tech startups to get access to the best talents. Building a startup team with shared passion and vision is not only the foundation of every great startup, it is the simplest way to build startup value since day one.

- Entry into new markets and segments: When the growth in your own market slows down, entering a new growing market (or segment) is a great way to increase the overall growth of your company. Instead of starting from scratch, you could minimize the expansion risk by acquiring a company with an established product, brand and market share. This type of acquisition comes with the added benefit of diversification for the buyer.

- Synergistic acquisitions: Sometimes the services that businesses offer are complimentary. For example, a manufacturer could acquire its suppliers in order to expand vertically and to control the full supply chain. Most mergers are synergistic, and the idea is that the new whole would be greater than its parts – the business will be able to reach more revenue while cutting overall costs. That said, mergers are not necessarily exited.

- Portfolio management: Many private equity and investment firms focus on building a portfolio of proven startups with growth potential. These companies may acquire your business to grow and sell it or to grow and hold its assets for the long-term. A great example such investment companies is Tiny Capital.

- Passive income: An entrepreneur or company could buy an easy-to-operate business to benefit from its sustainable cash flow. Blogs and some software as a service startups are good candidates for such acquisitions.

Keep in mind that this list is neither exhaustive nor exclusive. In fact, most acquisitions happen for a combination of the reasons listed above in addition to other, more case-specific reasons. According to CrunchBase, on average, successfully acquired venture-backed startups exit for $155.5 million on average.

Some notable examples are Microsoft’s acquisition of GitHub for $7.5B, Salesforce’s acquisition of Slack for $27.7B, Google’s acquisition of YouTube for $1.65B, etc.

Keeping this in mind, the deal values for small online businesses are much lower. You could buy a website on Flippa or other similar platforms for as low as $500.

2.2 Funding Rounds

While most people don’t think of funding rounds as exit events, they are for most startup investors. For example, the early pre-seed and seed investors usually liquidate some of their shares in the following venture-capital rounds (A, B, C, etc.).

While it’s not mandatory (or sometimes possible), the founders could also decide to do this. This is prudent for first-time founders who don’t have substantial personal wealth because this way they will transfer some of the risks to the venture funds. Even venture-backed startups fail.

(Source: CBInsights)

2.3 IPO

The typical exit for startups that don’t get acquired and at the same time grow into big businesses is an initial public offering (IPO). In other words, a company lists on a stock exchange and opens its doors to public investors.

In 2013, the average startup that went public raised $467.9 million before the IPO. It’s interesting that startups are on average taking longer to IPO because of the availability of capital in the startup ecosystem thanks to big venture capital funds.

3. Startup Exit Multiples & Valuations

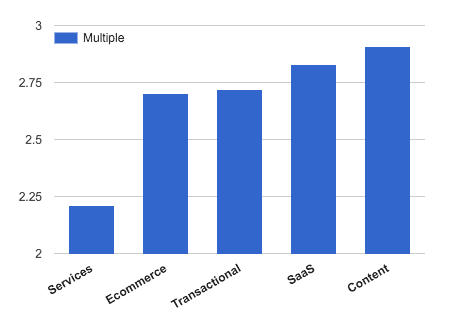

For the more commoditized small online businesses, the acquisition multiples are somewhat standard. They usually range between 2x to 3x the Seller’s Discretionary Earnings (SDE), which means net profit for the last 12 months excluding taxes, one-time expenses, and the owner’s compensation.

In other words, the average commoditized small online business sells roughly for the profits it’s able to generate for two to three years.

(Source: Website Buyer’s Report)

The median price for an online business of that sort was around $250k in 2019. It’s worth noting that the COVID-19 lockdown has in general driven the value of online businesses up. This is first and foremost because successful internet businesses are making more money on average (e.g. e-commerce market penetration has skyrocketed in 2020), but also because new entrepreneurs are looking for an entry into the online market, which drives up demand.

Larger businesses are usually sold based on an EBITDA multiple, which is also a type of profit multiple. Such businesses are usually sold for a higher multiple because they are more stable and have other valuable assets.

Some of the industries where companies get the highest valuation are:

- Professional Information Services: 25.30 x EBITDA

- Advanced Medical Equipment and Tech: 24.81 x EBITDA

- Financial & Commodity Market Operators & Service Providers: 24.35 x EBITDA

- Software: 24.35 x EBITDA

- Coal: 4.53 x EBITDA

- Oil & Gas Exploration and Production: 5.14 x EBITDA

- Iron & Steel: 5.92 x EBITDA

- Tires & Rubber Products: 6.63 x EBITDA

(Source: Equidam)

In the realm of tech startups, profit multiples might be more problematic because as stated above the fastest-growing startups are intentionally operating at a loss in order to capture market share. For such cases, revenue multiples could be used, but in some cases even such multiples are not reliable because the startup might have a giant audience that it’s not monetizing aggressively yet.

A good example is Facebook’s acquisition of WhatsApp for more than $19B, which is very hard to justify in purely financial terms (i.e. profit or revenue multiples), yet it might make sense in case Facebook is paying mostly to acquire the massive user base and to protect its monopolistic position in online communication, keeping in mind that WhatsApp is the chat app market leader in terms of monthly active users.

4. How To Prepare Your Startup For A Successful Exit

As we explained at the start of this guide, the first step towards positioning your startup right for a successful exit is to understand your business and to evaluate where you’re most likely to find the exit.

4.1 Partial Startup Exit Through Funding Rounds

If you are running an innovative, rapidly growing startup, the logical step is to fundraise and secure consecutive VC funding rounds.

First, you need to find the needed pre-seed and seed capital allowing you to develop your product idea and to find initial traction. It’s possible to bootstrap your way in these early stages, but if you intend to go on the venture capital path, a well-connected angel investor leading your seed rounds would be well-positioned and incentivized to get VCs interested in you, so it might be worth pursuing seed funding just for that alone.

Once you find proof of good product-market fit and manage to gain traction, you will be well-positioned to attract the attention of VCs with expertise and interest in your industry and hopefully – to convince them to lead a series A round for you.

To be able to do this efficiently, it would help a great deal if you are positioned in one of the world’s startup hubs (Silicon Valley, New York, London, Singapore, etc.). Most VCs only work with referrals, which means it’s important to be present and connected in the local startup community and it would be a hard task to attract the interest of a VC half the world away by cold-calling.

4.2 The Current Startup Funding Environment

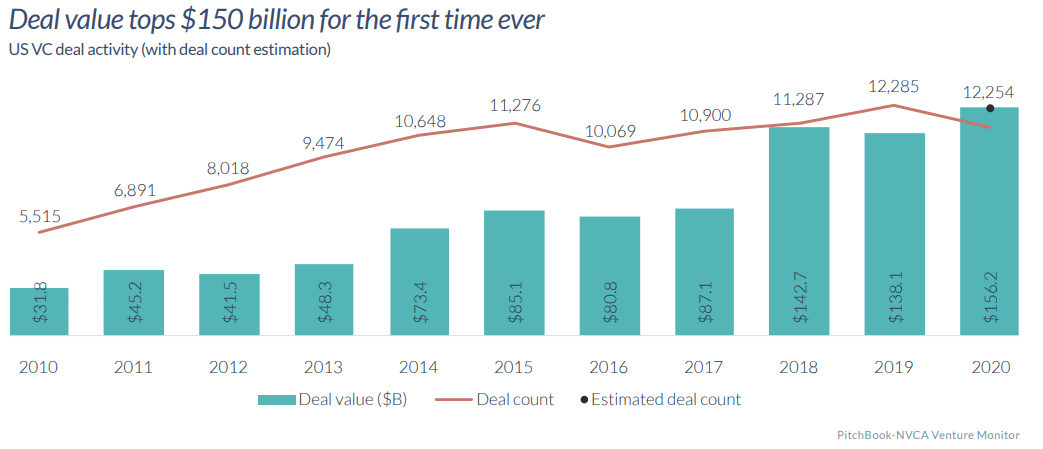

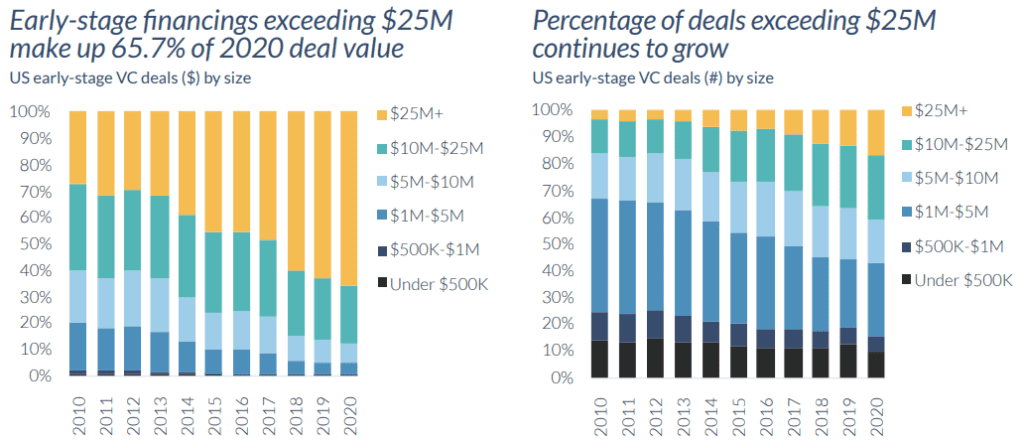

In the current economically uncertain environment, even the startup industry is growing more risk-averse. NVCA reports that although the total investment in high-growth startups in 2020 hit record-high levels, this was mainly led by very large investments in late-stage companies. While late-stage investments accounted for 28.8% of the deal count, they accounted for 66.7% of the total investment value.

(Source: NVCA)

Seed-stage and first-time financing activity has fallen in 2020, which makes the funding climate unfavorable for new entrepreneurs and new projects who cannot justify very high valuations. In light of this, bootstrapping your way into VC territory (series A) might be the only option for a lot of companies, especially if they are not well-connected.

(Source: NVCA)

At the same time, COVID-19 increased the rate of digitization of many industries (like e-commerce, telehealth, remote work and education, etc.), which means that although early-stage funding is hard to get, there might be great opportunities for innovation and even disruption.

4.3 Startup Exit Through Acquisition

If you’re running a more traditional, non-innovative online business, or a late-stage startup, your logical exit avenue is acquisition.

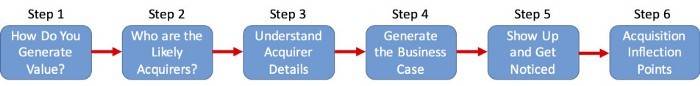

In order to position your company well for an acquisition, you need to first and foremost understand who your potential buyers are and what might make them interested.

For example, if you have a small commoditized online business like a dropshipping e-commerce store, your best bet is private investors (or small companies) that are interested in acquiring, growing, and later selling such businesses.

You have the best chance to find such buyers on online marketplaces like Flippa.com, EmpireFlippers.com, MicroAcquire or by hiring brokers who specialize in these deals. In order to successfully sell your startup and to get a high valuation, you need to make the due diligence easy and most importantly – to show a positive revenue growth trend.

If you have a larger business, you can still use the abovementioned methods, but you might also want to check with private equity funds (there are funds, for example, who specialize exclusively in SaaS businesses, etc.) or long-term startup portfolio holders like Tiny Capital.

Last but not least, if you have a rapidly-growing business that is well-positioned within a market with major players in it, your best bet would be a direct acquisition by one of your large direct or indirect competitors.

To succeed in attracting such a buyer, you need to understand the strengths of your business and to connect them to the reasons why your acquirers could be interested. Is the highlight of your startup the synergistic technology, the brand, the growing userbase, etc. If you are able to play-up your intangible assets, you might be able to get a much better valuation than the commoditized businesses mentioned above.

Making the acquisition work after your company is bought might also be important, especially if the acquisition deal has an earnout structure. Steve Blank suggests that insulating the startup from the acquiring corporation (while making use of the corporation’s resources) might be the best way forward for early-stage startups which are growing their product line and users.

(Source: thinkgrowth)

(Source: Steve Blank)

4.4 The Current Startup Acquisition Environment

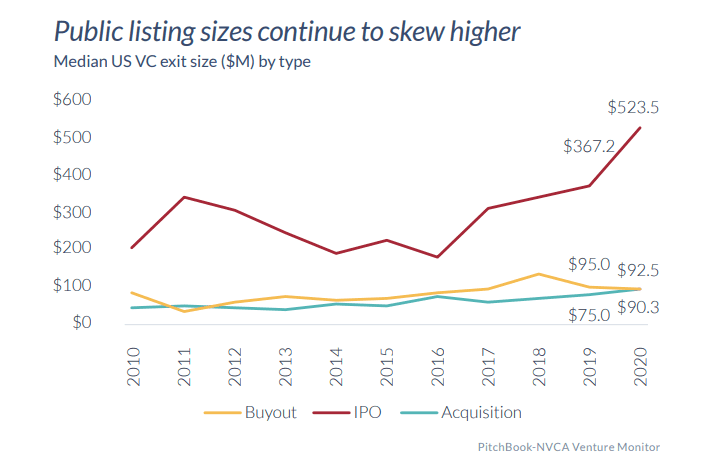

The last few years saw a rise in IPO exit size as well as a rise in the popularity of SPACS – publicly traded companies built with the goal of acquiring a private company and thus speeding up the IPO process. However, it’s worth noting that the average IPO exit size each year is skewed by the biggest IPOs.

(Source: NVCA)

While the Acquisition exit size is relatively stable in 2020, the deal count grew by 23%, which is great news for startups looking to get acquired.

This is not only true for highly valuable startups. The valuation and deal count are also growing on the marketplaces for buying small online businesses as the pandemic is enticing more people to enter the digital economy.

Summary

In order to maximize your chances of a successful exit, first and foremost you should understand the type of business that you are running or plan on building.

For lifestyle businesses, exits with high valuations are harder and might require very long organic growth.

For commoditized online businesses, exits usually happen through online platforms or brokers.

For scalable startups, the possible exit events are the venture capital funding rounds, strategic acquisitions by larger companies in a related industry, and finally – IPOs.

Make sure you understand well why a potential fund or company might be interested in your business in order to play up your strengths and maximize the likelihood of a deal happening and the valuation (multiple) you’re likely to get.